22+ mortgage gross income

Ad Tired of Renting. Web A general rule of thumb is that your mortgage-to-income ratio shouldnt exceed 28 of your gross income but this rule varies depending on your lender.

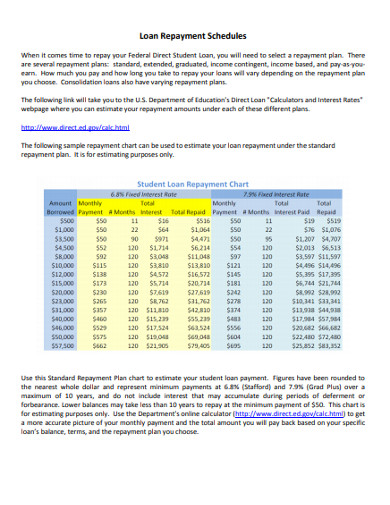

Repayment Schedule 10 Examples Format Pdf Examples

Web The Rule of 28 otherwise known as the percentage of income rule advises not spending more than 28 of your gross monthly income on your mortgage payment.

. With a Low Down Payment Option You Could Buy Your Own Home. To determine your front-end ratio multiply your annual income by 028 then divide that total by 12 for. Web A 20 down payment is ideal to lower your monthly payment avoid private mortgage insurance and increase your affordability.

Estimate your monthly mortgage payment. Web So if you collect 20000 per year in Social Security and have no other streams of retirement income your mortgage lender can gross up your annual income. For example if your gross monthly.

Thats your income before state and federal income tax deductions health. Veterans Use This Powerful VA Loan Benefit For Your Next Home. Were not including any expenses in estimating the income.

It is a type of secured loan which means that the house or real. Web For taxpayers who earn wages or a salary mortgage lenders typically look at gross income. Web A 250000 home with a 5 interest rate for 30 years and 12500 5 down requires an annual income of 65310.

For a 250000 home a down payment of 3. Explore Quotes from Top Lenders All in One Place. Web Lenders usually dont want you to spend more than 31 to 36 of your monthly income on principal interest property taxes and insurance.

Web A mortgage is a loan that is used to buy or refinance a house or any other real estate property. Compare Offers Side by Side with LendingTree. Gross income Σ income earned Gross income for individuals Heres the formula for calculating your gross.

With a Low Down Payment Option You Could Buy Your Own Home. Determine your gross annual salary which is the total amount you earn per year before deductions. Ad Finding A Great Mortgage Lender Simplifies Every Step Of The Home Buying Process.

Your 2022 tax bracket is based on your taxable income and tax filing status. Ad Calculate Your Payment with 0 Down. Web Lets say your gross income is 5000 per month.

Web For example if you apply for a conventional mortgage then youre typically allowed a monthly mortgage payment up to 28 of your gross monthly income. Web There are currently seven federal income tax brackets. Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You.

Web To use this calculation to figure out how much you can afford to spend multiply your gross monthly income by 028. Web Typically lenders cap the mortgage at 28 percent of your monthly income. You pay 1000 toward the principal and interest 150 toward property taxes 100 toward homeowners insurance and 50 in.

We moved to a MCOL area hour south of Seattle in WA where the homes we like are falling into the. Web Income mortgage calculation How to calculate net pay. Ad See how much house you can afford.

Web In AZ our monthly mortgage payment was about 12 of out gross income. Why Rent When You Could Own. Web The formula for calculating gross income is.

Most mortgage programs require homeowners to. Begin Your Loan Search Right Here. Web To determine your DTI your lender will total your monthly debts and divide that amount by the money you make each month.

10 12 22 24 32 35 and 37. Web The 28 mortgage rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg principal interest taxes and insurance. Web The amount of the credit is 100 percent of the first 2000 of qualified education expenses you paid for each eligible student and 25 percent of the next 2000.

Lets say your total. Web The 28 Rule For Mortgage Payments The often-referenced 28 rule says that you shouldnt spend more than that percentage of your monthly gross income on. Ad Get the Right Housing Loan for Your Needs.

How Much House Can I Afford Moneyunder30

What Percentage Of Income Should Go To A Mortgage Bankrate

Household Budget Worksheet Simple Monthly Budget Template Simple Monthly Budget Tem Monthly Budget Template Budgeting Worksheets Household Budget Worksheet

How Much Of My Income Should Go Towards A Mortgage Payment

How Much House Can I Afford Moneyunder30

9 Free Sample Home Mortgage Checklists Printable Samples

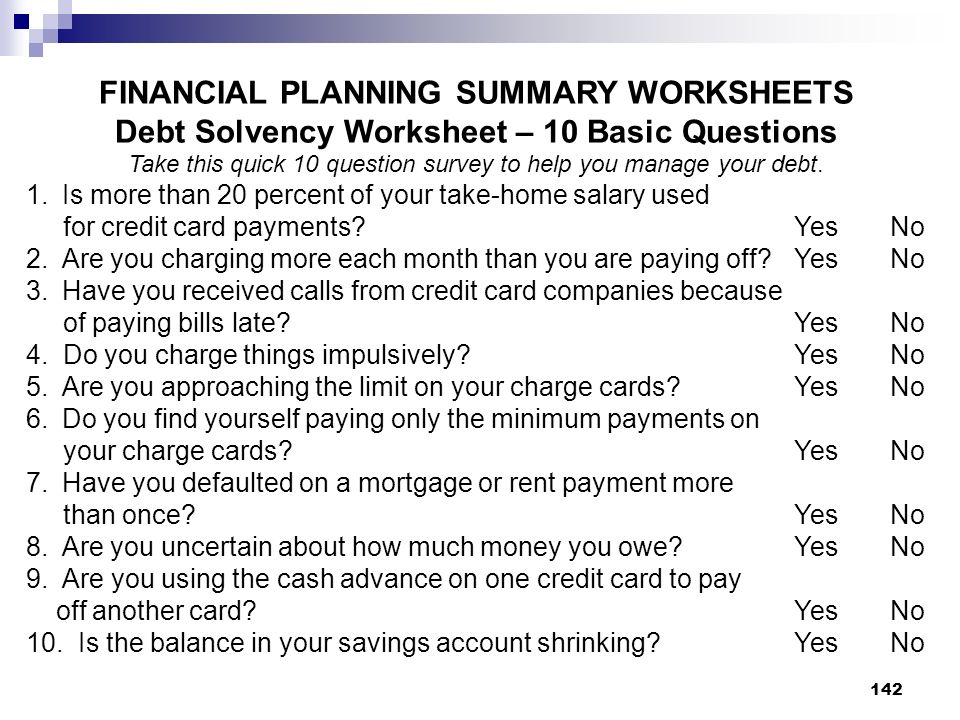

Personal Financial Planning For Divorce Fpa Ma November 19 Ppt Download

![]()

1 Manufactured Home Loan Calculator How Much Can You Afford Manufactured Nationwide Home Loans 1 Manufactured Home Loan Lender In All 50 States

What Percentage Of Income Should Go To A Mortgage Bankrate

Definition Of Gross Income For Mortgage Calculation Budgeting Money The Nest

Green Dragon House Investor Brochure

What Percentage Of Your Income Should Go To Mortgage Chase

:max_bytes(150000):strip_icc()/credit-score-factors-4230170-v22-897d0814646e4fc188473be527ea7b8a.png)

The 5 Biggest Factors That Affect Your Credit

What Percentage Of Your Income Should Go To Your Mortgage Hometap

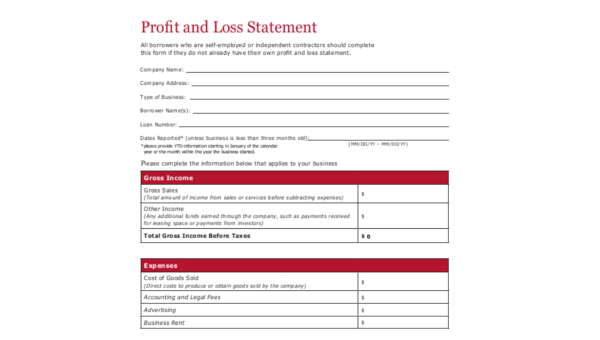

Free 8 Profit And Loss Statement Samples In Ms Excel Pdf

Home Loans Geelong Geelong S Local Mortgage Broker

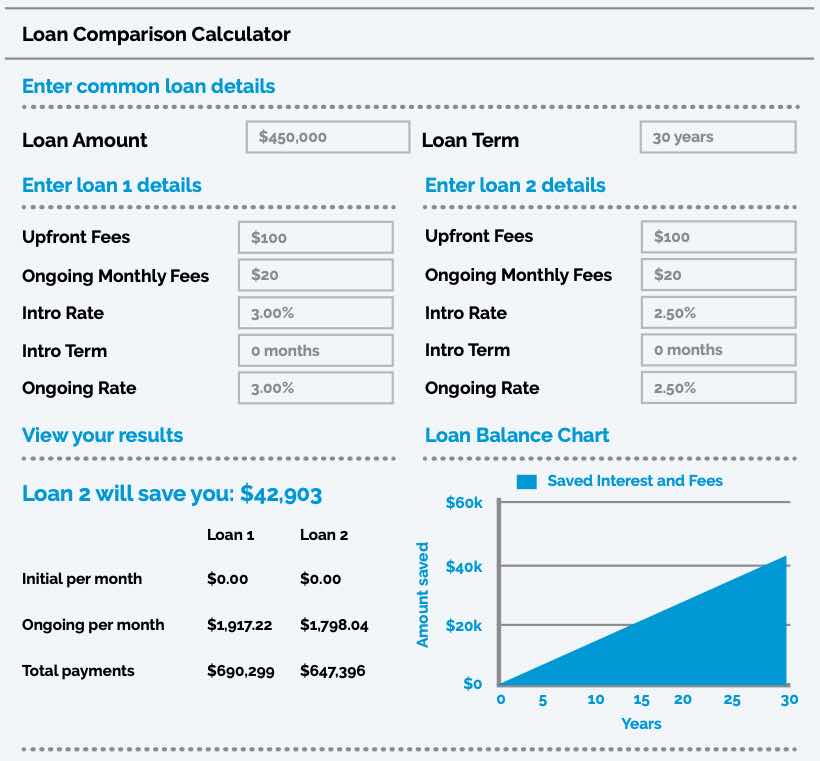

20 Hour Safe Loan Originator Pre Licensing Slides 2017 2018